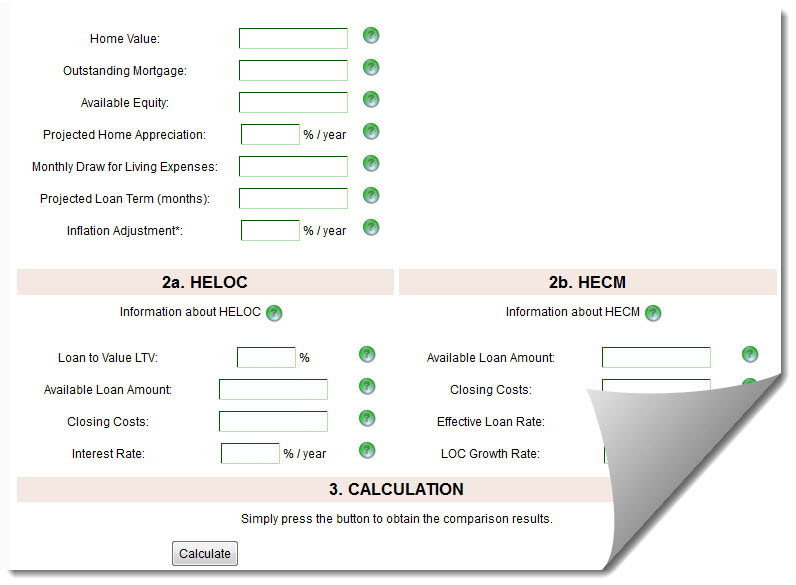

#NRMLA REVERSE MORTGAGE CALCULATOR PLUS#

Modified Term - combination of line of credit plus monthly payments for a fixed period of months selected by the borrower.Modified Tenure - combination of line of credit and scheduled monthly payments for as long as you remain in the home.Line of Credit - unscheduled payments or in installments, at times and in an amount of your choosing until the line of credit is exhausted.Term - equal monthly payments for a fixed period of months selected.Tenure - equal monthly payments as long as at least one borrower lives and continues to occupy the property as a principal residence.For adjustable interest rate mortgages, you can select one of the following payment plans:.

They are more expensive than traditional home loans or single-purpose reverse mortgages and the financing costs are higher, a factor if the home stay is short or the mortgage is small. Department of Housing and Urban Development (HUD). The Federal Housing Administration's (FHA's) Home Equity Conversion Mortgage (HECM) is a federally-insured mortgage backed by the U. FHA Home Equity Conversion Mortgage (HECM) There are three types or reverse mortgages: FHA Home Equity Conversion Mortgage (HECM), single-purpose reverse mortgage, and proprietary reverse mortgage. For FHA Home Equity Conversion Mortgages, the FHA covers any difference between the sale value and the mortgage balance, preventing "underwater" loans. Reverse mortgages are now regulated by the Federal Housing Administration and the Consumer Financial Protection Bureau. The number of reverse mortgages dropped from an annual peak of about 115,000 in 2009 to 30,000 in 2016, according to the Federal Housing Administration.

Reverse mortgages saw abuses by lenders and earned a bad reputation when the housing bubble burst in 2008-2010.

In 1987 Congress passed a reverse mortgage pilot program called the Home Equity Conversion Mortgage Demonstration, signed into law in 1988. The first reverse mortgage in the United States was issued in 1961. In certain situations, a non-borrowing spouse may be able to remain in the home. When the last surviving borrower dies, sells the home, or no longer lives in the home as a principal residence, the loan has to be repaid. A reverse mortgage has been described as a loan of last resort because it can mean fewer assets for the homeowner and heirs. In 2009, half of homeowners 62 or older had 55% or more of their net worth in home equity. A reverse mortgage allows homeowners 62 and older to withdraw a portion of home equity as income or a line of credit without selling the home or making monthly payments.

0 kommentar(er)

0 kommentar(er)